2025 Membrane Electrode Assembly Manufacturing for Proton Exchange Membrane Fuel Cells: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Growth Drivers, Regional Trends, and Competitive Insights Shaping the Industry.

- Executive Summary & Market Overview

- Key Market Drivers and Restraints

- Technology Trends in Membrane Electrode Assembly Manufacturing

- Competitive Landscape and Leading Players

- Growth Forecasts and Market Sizing (2025–2030)

- Regional Analysis: Opportunities and Hotspots

- Challenges, Risks, and Market Entry Barriers

- Opportunities and Strategic Recommendations

- Future Outlook: Innovations and Market Evolution

- Sources & References

Executive Summary & Market Overview

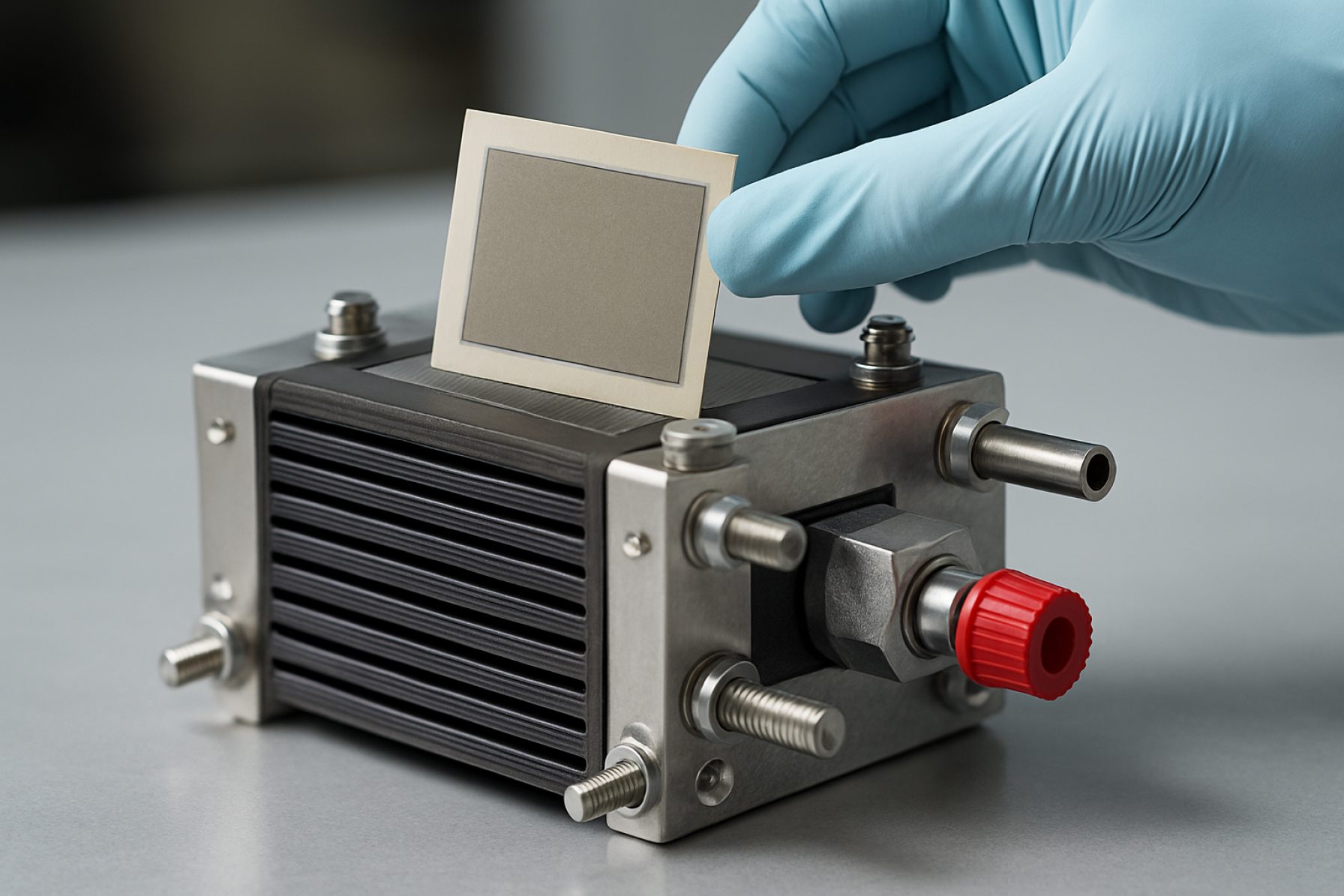

The membrane electrode assembly (MEA) is the core component of proton exchange membrane fuel cells (PEMFCs), directly impacting their efficiency, durability, and cost. As the global push for decarbonization accelerates, MEA manufacturing has emerged as a critical segment within the hydrogen economy and clean energy value chain. The MEA market is experiencing robust growth, driven by increasing adoption of PEMFCs in transportation (notably fuel cell electric vehicles), stationary power generation, and portable applications.

According to MarketsandMarkets, the global MEA market for fuel cells is projected to reach USD 1.4 billion by 2025, growing at a CAGR of over 18% from 2020. This expansion is underpinned by government incentives, tightening emission regulations, and significant investments in hydrogen infrastructure, particularly in Asia-Pacific, Europe, and North America. Major automotive OEMs such as Toyota Motor Corporation, Hyundai Motor Company, and Honda Motor Co., Ltd. are scaling up fuel cell vehicle production, further stimulating demand for high-performance MEAs.

The MEA manufacturing landscape is characterized by rapid technological advancements aimed at reducing platinum group metal (PGM) loading, improving catalyst utilization, and enhancing membrane durability. Leading suppliers such as W. L. Gore & Associates, 3M, and Ballard Power Systems are investing in next-generation MEA designs and automated production processes to achieve cost parity with incumbent technologies. Additionally, the emergence of new entrants and partnerships—such as Umicore and BASF—is intensifying competition and accelerating innovation.

Despite strong growth prospects, the MEA manufacturing sector faces challenges related to supply chain constraints, raw material price volatility (notably for PGMs), and the need for large-scale, cost-effective production. Addressing these issues is crucial for enabling the mass adoption of PEMFCs across diverse sectors. In summary, the MEA manufacturing market in 2025 is poised for significant expansion, underpinned by technological innovation, strategic investments, and the global transition toward sustainable energy systems.

Key Market Drivers and Restraints

The membrane electrode assembly (MEA) is the core component of proton exchange membrane (PEM) fuel cells, directly impacting their efficiency, durability, and cost. The market for MEA manufacturing is shaped by a dynamic interplay of drivers and restraints as the global energy landscape shifts toward decarbonization and clean mobility.

Key Market Drivers

- Rising Demand for Clean Energy Solutions: The global push for decarbonization, reinforced by government policies and net-zero targets, is accelerating the adoption of PEM fuel cells in transportation, stationary power, and portable applications. This trend is particularly pronounced in regions such as Europe, North America, and Asia-Pacific, where hydrogen strategies and incentives are fostering market growth (International Energy Agency).

- Automotive Sector Expansion: Major automotive manufacturers are investing in fuel cell electric vehicles (FCEVs), driving demand for high-performance MEAs. Companies like Toyota Motor Corporation and Hyundai Motor Group are scaling up production, necessitating advancements in MEA manufacturing to meet cost and durability requirements.

- Technological Advancements: Innovations in catalyst materials, membrane durability, and manufacturing automation are reducing costs and improving MEA performance. The development of low-platinum or platinum-free catalysts and roll-to-roll manufacturing processes are particularly significant (Fuel Cell Bipolar Plate).

- Government Funding and R&D Initiatives: Substantial public and private investments in hydrogen infrastructure and fuel cell R&D are catalyzing MEA manufacturing capacity expansion (U.S. Department of Energy).

Key Market Restraints

- High Production Costs: The reliance on precious metals (notably platinum) and complex manufacturing processes keeps MEA costs elevated, limiting large-scale commercial adoption (IDTechEx).

- Durability and Lifetime Challenges: MEAs must withstand harsh operating conditions, and current materials can degrade over time, impacting fuel cell longevity and increasing replacement costs (National Renewable Energy Laboratory).

- Supply Chain Constraints: Limited availability of high-purity materials and specialized manufacturing equipment can create bottlenecks, especially as demand surges (International Energy Agency).

- Competition from Alternative Technologies: Advances in battery electric vehicles and other hydrogen fuel cell types (e.g., solid oxide) may divert investment and slow MEA market growth in certain segments (Bloomberg).

Technology Trends in Membrane Electrode Assembly Manufacturing

Membrane Electrode Assembly (MEA) manufacturing for Proton Exchange Membrane Fuel Cells (PEMFCs) is undergoing rapid technological evolution as the industry seeks to improve performance, reduce costs, and scale up production for automotive, stationary, and portable applications. In 2025, several key technology trends are shaping the MEA manufacturing landscape:

- Advanced Catalyst Coating Techniques: The shift from traditional decal and spraying methods to advanced catalyst-coated membrane (CCM) processes is accelerating. Techniques such as slot-die coating and ultrasonic spraying are enabling more uniform catalyst layers, reducing precious metal loading, and improving reproducibility. These methods are being adopted by leading manufacturers to enhance throughput and lower costs, as highlighted by Ballard Power Systems and Nel Hydrogen.

- Automation and Inline Quality Control: Automation is increasingly integrated into MEA production lines, with robotics and machine vision systems ensuring precise layer alignment and defect detection. Inline quality control using spectroscopy and imaging is reducing waste and improving yield, a trend noted in IDTechEx market research.

- Roll-to-Roll Manufacturing: To meet the growing demand for fuel cells, roll-to-roll (R2R) manufacturing is being widely adopted. This continuous process allows for high-volume, scalable production of MEAs, significantly lowering per-unit costs. Companies such as Umicore are investing in R2R lines to support automotive OEMs and other high-volume customers.

- Material Innovations: The development of new ionomer membranes with higher conductivity and durability, as well as non-platinum group metal (PGM) catalysts, is a major focus. These innovations aim to reduce reliance on scarce materials and improve the lifetime of MEAs, as reported by National Renewable Energy Laboratory (NREL).

- Digital Twin and Data Analytics: The use of digital twin technology and advanced data analytics is optimizing MEA manufacturing processes. By simulating production and predicting outcomes, manufacturers can minimize downtime and accelerate process improvements, a trend supported by Fuel Cells and Hydrogen Joint Undertaking (FCH JU) initiatives.

These technology trends are collectively driving the PEMFC MEA manufacturing sector toward greater efficiency, scalability, and cost-effectiveness, positioning it for broader commercial adoption in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of membrane electrode assembly (MEA) manufacturing for proton exchange membrane (PEM) fuel cells in 2025 is characterized by a mix of established multinational corporations, specialized component suppliers, and emerging technology startups. The market is driven by the accelerating adoption of fuel cell electric vehicles (FCEVs), stationary power systems, and backup power solutions, particularly in Asia, Europe, and North America.

Leading players in the MEA manufacturing sector include 3M, W. L. Gore & Associates, Toray Industries, Ballard Power Systems, and Hyundai Motor Company. These companies leverage advanced materials science, proprietary catalyst technologies, and large-scale production capabilities to maintain their competitive edge. For instance, W. L. Gore & Associates is recognized for its high-performance proton exchange membranes, while 3M focuses on innovative catalyst layer designs to enhance durability and efficiency.

Asian manufacturers, particularly from Japan, South Korea, and China, are rapidly expanding their presence. Toray Industries and Tokuyama Corporation are notable for their vertically integrated supply chains and partnerships with automotive OEMs. Chinese firms such as SinoHytec and REFIRE are scaling up production to meet domestic demand, supported by government incentives and investments in hydrogen infrastructure.

Startups and research-driven companies are also shaping the competitive landscape by introducing novel MEA architectures and cost-reduction strategies. Companies like Advent Technologies and Cummins Inc. are investing in next-generation catalysts and manufacturing automation to improve performance and lower production costs.

- Strategic partnerships and joint ventures are common, as seen in collaborations between Ballard Power Systems and Weichai Power for the Chinese market.

- Intellectual property portfolios and proprietary manufacturing processes are key differentiators, with leading players investing heavily in R&D.

- Market entry barriers remain high due to the technical complexity and capital intensity of MEA production.

Overall, the MEA manufacturing sector for PEM fuel cells in 2025 is marked by intense competition, rapid technological innovation, and increasing consolidation as companies seek to achieve economies of scale and secure long-term supply agreements with automotive and industrial customers.

Growth Forecasts and Market Sizing (2025–2030)

The global market for membrane electrode assembly (MEA) manufacturing for proton exchange membrane (PEM) fuel cells is poised for robust growth in 2025, driven by accelerating adoption in automotive, stationary, and portable power applications. According to projections by MarketsandMarkets, the MEA market is expected to reach a valuation of approximately USD 1.1 billion in 2025, up from an estimated USD 0.8 billion in 2023, reflecting a compound annual growth rate (CAGR) of over 15%.

This growth is underpinned by several converging factors. The automotive sector remains the primary demand driver, with leading automakers such as Toyota Motor Corporation and Hyundai Motor Group ramping up production of fuel cell electric vehicles (FCEVs). In parallel, government policies in regions like Europe, China, and South Korea are incentivizing the deployment of hydrogen infrastructure and fuel cell technologies, further stimulating MEA demand.

On the manufacturing front, capacity expansions and technological advancements are expected to improve production efficiency and reduce costs. Companies such as Ballard Power Systems and W. L. Gore & Associates have announced new or expanded MEA manufacturing facilities, targeting both scale and quality improvements. These investments are anticipated to address supply chain bottlenecks and meet the rising order volumes from OEMs and system integrators.

Regionally, Asia-Pacific is projected to account for the largest share of the MEA manufacturing market in 2025, led by China, Japan, and South Korea. This dominance is attributed to aggressive national hydrogen strategies and the presence of major fuel cell stack manufacturers. Europe and North America are also expected to see significant growth, particularly in heavy-duty transport and backup power segments.

In summary, 2025 will mark a pivotal year for MEA manufacturing for PEM fuel cells, with market sizing and growth forecasts reflecting both surging end-use demand and strategic industry investments. The sector’s trajectory is set to accelerate further as cost reductions and policy support continue to align.

Regional Analysis: Opportunities and Hotspots

The global landscape for membrane electrode assembly (MEA) manufacturing in proton exchange membrane (PEM) fuel cells is rapidly evolving, with distinct regional opportunities and emerging hotspots shaping the industry’s trajectory in 2025. The Asia-Pacific region, led by China, Japan, and South Korea, continues to dominate MEA production, driven by robust government support, aggressive hydrogen strategies, and a burgeoning electric vehicle (EV) and fuel cell vehicle (FCV) market. China, in particular, has established itself as a manufacturing powerhouse, leveraging its extensive supply chain, cost advantages, and policy incentives to attract both domestic and international investment in MEA facilities. The Chinese government’s “Hydrogen Energy Industry Development Plan (2021-2035)” underscores its commitment to scaling up fuel cell technologies, with a focus on localizing MEA production to reduce reliance on imports and enhance competitiveness (The State Council of the People's Republic of China).

Japan remains a critical hotspot, propelled by its “Basic Hydrogen Strategy” and the presence of leading automotive and electronics companies investing in PEM fuel cell R&D and manufacturing. Japanese firms are at the forefront of high-performance MEA development, targeting both mobility and stationary power applications (Ministry of Economy, Trade and Industry (METI) Japan). South Korea is also scaling up MEA production, supported by its “Hydrogen Economy Roadmap” and the expansion of domestic fuel cell vehicle fleets (Ministry of Trade, Industry and Energy, Republic of Korea).

In Europe, Germany stands out as a manufacturing and innovation hub, benefiting from the European Union’s Green Deal and Hydrogen Strategy, which prioritize local MEA production to support the continent’s decarbonization goals. German companies are investing in advanced manufacturing processes and automation to scale up production and reduce costs (NOW GmbH). France and the Nordic countries are also emerging as key players, with targeted investments in fuel cell supply chains and pilot projects.

North America, particularly the United States, is witnessing renewed momentum due to the Inflation Reduction Act and Department of Energy initiatives that incentivize domestic MEA manufacturing. The U.S. is focusing on building a resilient supply chain, fostering public-private partnerships, and supporting scale-up through grants and tax credits (U.S. Department of Energy).

Overall, the regional MEA manufacturing landscape in 2025 is characterized by strategic government backing, localization of supply chains, and a race to achieve cost-effective, high-performance assemblies, with Asia-Pacific, Europe, and North America emerging as the principal hotspots for growth and investment.

Challenges, Risks, and Market Entry Barriers

The membrane electrode assembly (MEA) is the core component of proton exchange membrane fuel cells (PEMFCs), directly impacting performance, durability, and cost. However, the manufacturing of MEAs for PEMFCs faces several significant challenges, risks, and market entry barriers as the industry moves into 2025.

- Technical Complexity and Quality Control: MEA manufacturing requires precise control over catalyst layer deposition, membrane handling, and hot-pressing processes. Achieving uniform catalyst distribution and optimal interface bonding is technically demanding, with small deviations leading to performance losses or reduced durability. Scaling up from laboratory to mass production without sacrificing quality remains a persistent challenge, as highlighted by National Renewable Energy Laboratory.

- High Capital and Operational Costs: The production of MEAs involves expensive materials, notably platinum-group metal catalysts and perfluorosulfonic acid membranes. Capital investment in specialized coating, drying, and assembly equipment is substantial. These costs create a high barrier for new entrants and limit the ability of smaller firms to compete with established players such as W. L. Gore & Associates and 3M.

- Intellectual Property (IP) Landscape: The MEA sector is characterized by dense patent portfolios covering catalyst formulations, membrane chemistries, and manufacturing methods. Navigating this IP landscape is complex and costly, with risks of infringement litigation or the need for expensive licensing agreements, as noted by International Energy Agency.

- Supply Chain Vulnerabilities: The reliance on critical raw materials, especially platinum and high-performance polymers, exposes manufacturers to price volatility and supply disruptions. Geopolitical factors and limited supplier diversity further exacerbate these risks, as reported by Fuel Cells and Hydrogen Joint Undertaking.

- Market Uncertainty and Demand Fluctuations: The PEMFC market is still emerging, with demand closely tied to policy incentives, hydrogen infrastructure development, and the pace of electrification in transport and stationary power. This uncertainty complicates capacity planning and investment decisions for MEA manufacturers.

Collectively, these factors create a challenging environment for new entrants and require established manufacturers to continuously innovate and invest in process optimization to maintain competitiveness in the evolving PEMFC market.

Opportunities and Strategic Recommendations

The membrane electrode assembly (MEA) is the core component of proton exchange membrane fuel cells (PEMFCs), directly impacting efficiency, durability, and cost. As the global push for decarbonization accelerates, the MEA manufacturing sector is poised for significant growth and transformation in 2025. Several key opportunities and strategic recommendations can be identified for stakeholders aiming to capitalize on this evolving market.

- Scale-Up and Automation: The transition from pilot-scale to mass production remains a critical opportunity. Automated, high-throughput manufacturing lines can reduce unit costs and improve consistency. Companies investing in advanced roll-to-roll coating, precision catalyst application, and in-line quality control will be well-positioned to meet the anticipated surge in demand, especially from the automotive and stationary power sectors (Ballard Power Systems).

- Material Innovation: There is a growing need for MEAs with higher power density, longer lifespans, and reduced platinum group metal (PGM) content. Strategic partnerships with material science firms and research institutions can accelerate the development of next-generation ionomers, catalysts, and gas diffusion layers. Companies that can commercialize low-PGM or PGM-free MEAs will gain a competitive edge as cost reduction remains a top priority (National Renewable Energy Laboratory).

- Localization and Supply Chain Resilience: Geopolitical uncertainties and supply chain disruptions have highlighted the importance of localizing MEA production. Establishing regional manufacturing hubs, particularly in Europe, North America, and East Asia, can mitigate risks and align with government incentives for domestic clean energy manufacturing (S&P Global).

- Strategic Alliances and Licensing: Forming alliances with OEMs, system integrators, and end-users can secure long-term supply agreements and facilitate co-development of tailored MEA solutions. Licensing proprietary manufacturing processes or materials can also generate new revenue streams and accelerate market penetration (Bloom Energy).

- Market Diversification: While automotive applications dominate headlines, significant opportunities exist in backup power, material handling, and portable electronics. Diversifying the customer base can buffer against sector-specific volatility and tap into emerging markets with high growth potential (IDTechEx).

In summary, MEA manufacturers should prioritize automation, material innovation, supply chain localization, strategic partnerships, and market diversification to capture value in the rapidly expanding PEMFC sector in 2025.

Future Outlook: Innovations and Market Evolution

The future outlook for membrane electrode assembly (MEA) manufacturing in proton exchange membrane (PEM) fuel cells is shaped by rapid technological innovation and evolving market dynamics as the industry approaches 2025. MEAs are the core component of PEM fuel cells, directly impacting efficiency, durability, and cost. As global decarbonization efforts intensify, demand for PEM fuel cells in transportation, stationary power, and portable applications is accelerating, driving significant investment in MEA manufacturing advancements.

Key innovations are focused on improving catalyst utilization, reducing precious metal content (notably platinum), and enhancing membrane durability. Companies are increasingly adopting advanced catalyst deposition techniques, such as atomic layer deposition and inkjet printing, to achieve uniform catalyst layers and minimize material waste. For example, 3M and Toyochem are developing proprietary methods to optimize catalyst distribution and binder integration, resulting in higher power densities and longer MEA lifespans.

Automation and scale-up of MEA production lines are also pivotal. Leading manufacturers like W. L. Gore & Associates and Ballard Power Systems are investing in roll-to-roll processing and in-line quality control systems to boost throughput and consistency, addressing the cost barriers that have historically limited PEM fuel cell adoption. These advancements are expected to reduce MEA production costs by up to 30% by 2025, according to projections from IDTechEx.

- Material innovation: Research into non-fluorinated membranes and alternative ionomers is gaining traction, with entities like DuPont and Chemours leading efforts to develop membranes with higher conductivity and chemical stability.

- Recycling and sustainability: Circular economy initiatives are emerging, with companies exploring recycling of spent MEAs and recovery of precious metals, aligning with global sustainability goals.

- Regional expansion: Asia-Pacific, particularly China, is rapidly scaling MEA manufacturing capacity, supported by government incentives and partnerships, as highlighted by BloombergNEF.

By 2025, the MEA manufacturing landscape is expected to be characterized by greater automation, material efficiency, and regional diversification, positioning PEM fuel cells as a more viable solution for mainstream decarbonization and energy transition strategies.

Sources & References

- MarketsandMarkets

- Toyota Motor Corporation

- Hyundai Motor Company

- W. L. Gore & Associates

- Ballard Power Systems

- Umicore

- BASF

- International Energy Agency

- IDTechEx

- National Renewable Energy Laboratory

- Nel Hydrogen

- Toray Industries

- Tokuyama Corporation

- SinoHytec

- REFIRE

- Advent Technologies

- Weichai Power

- The State Council of the People's Republic of China

- Ministry of Trade, Industry and Energy, Republic of Korea

- Bloom Energy

- W. L. Gore & Associates

- DuPont

- BloombergNEF