- Institutions control 88% of McKesson’s shares, highlighting their significant influence on the company’s future.

- The Vanguard Group holds the largest single stake at 9.5%, but no shareholder has overwhelming control, emphasizing collective power.

- The general public represents 11% of ownership, with limited but meaningful influence on McKesson’s trajectory.

- Insiders own less than 1%, with $65 million in shares, aligning with shareholder interests despite their small stake.

- Understanding ownership dynamics, alongside analyst forecasts, is key to navigating potential risks and opportunities.

- McKesson’s story exemplifies the complex interplay of institutional power and market sentiment in corporate decision-making.

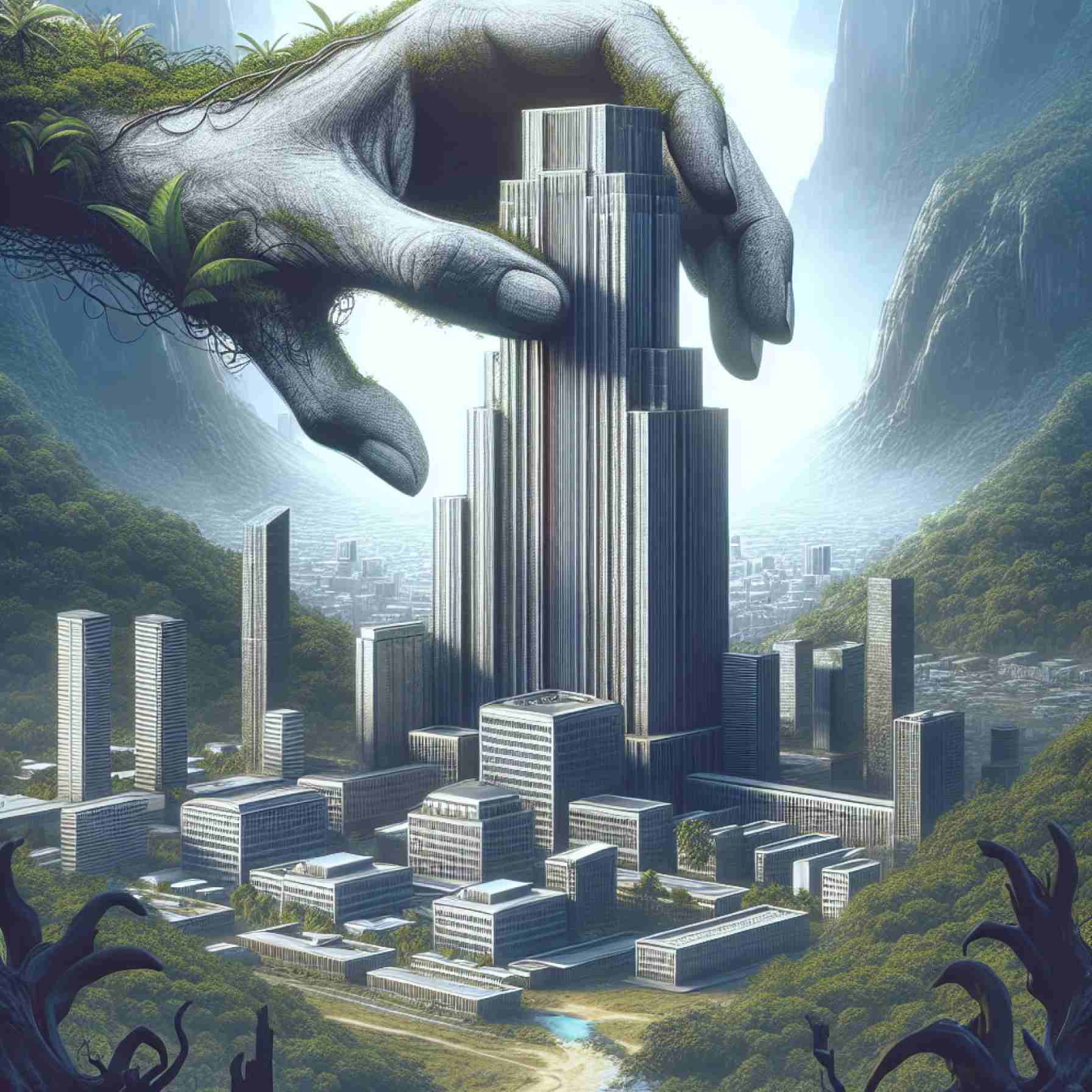

Step into the enigmatic world where institutions pull the strings behind the corporate tableau, and you’ll find McKesson Corporation occupying a top tier. Seemingly innocuous on the surface, the truth beneath the sprawling empire (NYSE: MCK) reveals a world where the whims and convictions of institutional investors hold sway over its future.

With institutions commanding a staggering 88% of McKesson’s shares, the company morphs into a battleground of elite financial minds. Like chess masters strategizing their next moves, these institutional investors wield immense power, their choices echoing across trading floors worldwide. While some may see this dominance as a beacon of trust in McKesson’s prospects, others view it as a theater of risk, where crowd behavior could trigger precipitous declines at the slightest misstep.

The Vanguard Group stands as the Goliath among McKesson’s shareholders, clutching 9.5% of the pie. It’s an epic tale of stakes and strategies, with the second and third largest shareholders vying for influence at 7.3% and 4.6% respectively. Yet no single behemoth looms large enough to control more than half, meaning the power lies not in singular dominance but collective clout.

Amidst this orchestrated financial ballet, the general public—the everyday investors—hold a modest 11%. Although they represent the individual, this group cannot call the shots but can still influence the rhythm and direction of McKesson’s ambitious journey forward.

Vibrant as it is daunting, the insiders, the so-called custodians of the brand, own less than 1%—their role pivotal yet circumscribed. However, the significance of these stakeholders extends beyond mere numbers. Their ownership of $65 million in shares paints a poignant narrative of alignment with broader shareholder interests, though their individual power remains shadowed by the institutional giants.

Investors looking to decode McKesson’s trajectory must embrace the dual language of numbers and sentiments, interpreting ownership figures alongside analyst forecasts. Even as the company’s future is sealed in the dance of percentages and predictions, the narrative underscores a timeless truth: in the world of high finance, it is the unseen decision-makers, the institutions that propel or anchor a company’s ascent.

What emerges from this story is a sobering reminder and an opportunity—to understand the dynamics of ownership is to peer into the heart of potential and risk. This knowledge, in an age where AI promises to revolutionize healthcare and new opportunities patina with gold, equips investors to make savvy choices, ensuring they are not merely spectators but informed participants in the unfolding saga of corporate power and profit.

Who Holds the Reins? Exploring McKesson’s Institutional Power Structure

Understanding McKesson’s Institutional Grip

McKesson Corporation (NYSE: MCK) is not just a healthcare giant; it is a vivid tableau of institutional power dynamics, with 88% of its shares controlled by institutional investors. This ownership landscape highlights a delicate balance of power, where investment behemoths shape the future through strategic moves akin to a chess game.

How Institutional Investors Influence McKesson

The substantial control exerted by institutions such as The Vanguard Group, holding 9.5%, reflects a complex blend of trust and risk. This institutional dominance could be seen as a vote of confidence in McKesson’s leadership and future prospects. However, the involvement of such heavyweight investors often comes with its own set of risks, primarily because collective moves by these institutions can trigger significant stock price shifts, influenced by broader market sentiments.

Real-World Use Cases: Institutional Impact on Growth

1. Strategic Investments: Institutional investors often push for strategic partnerships or new technologies to maintain competitive edges, consequently influencing company decisions at the board level.

2. Corporate Governance: With substantial shares, these investors can sway governance practices, advocating for measures that could lead to better financial performance, such as improved transparency or sustainability initiatives.

3. Market Trends: These investors have the clout to subtly influence market perceptions, potentially aligning with or against emerging industry trends such as digital transformation in healthcare.

McKesson’s Ownership Dynamics: The General Public and Insiders

Role of Individual Investors

While institutional investors dominate, the general public still holds 11% of shares. This bloc, though less powerful, represents a collective voice that can impact corporate decisions through shareholder voting rights and by advocating for certain governance practices.

Insider Ownership

Insiders, although holding less than 1% of shares, possess a keen interest in the company’s profitability and overall strategic direction. Their stock ownership, worth $65 million, signals confidence in McKesson’s trajectory, though their influence is mainly symbolic compared to institutional investors.

Market Forecast and Industry Trends

As industries increasingly embrace AI and digital solutions, McKesson’s investors may explore opportunities to integrate these technologies, potentially enhancing healthcare delivery efficiency and accuracy. This transformation is likely a critical factor in institutional forecasts and investment decisions.

Pros and Cons of Institutional Dominance

Pros:

– Expertise and Resources: Institutional investors typically have access to a wealth of resources and industry expertise, guiding smarter investment strategies.

– Stability and Growth Capital: Large investments provide liquidity and stability, encouraging long-term growth initiatives.

Cons:

– Volatility Risks: Simultaneous buy/sell decisions from these investors can lead to significant market volatility.

– Less Flexibility: Decisions might be overly influenced by short-term gains rather than long-term growth and sustainability.

Actionable Recommendations for Investors

1. Stay Informed: Keep abreast of institutional trading patterns and stock analyst reports to anticipate possible market shifts.

2. Diversify Portfolio: Reduce risk by diversifying investments across multiple sectors and companies.

3. Engage in Shareholder Meetings: Whether an institutional or individual investor, participate actively in shareholder meetings to influence corporate governance.

For more insights into stock market dynamics and investment strategies, visit Investopedia.

In this captivating field of corporate influence, understanding institutional playbook strategies and market trends empowers investors to transition from passive observers to proactive participants in the company’s ongoing narrative.